Santa Rosalia in Murcia is an award winning development. Built off plan many properties are due to complete in 2026. Obtain a financial approval for a Spanish Mortgage ready for completion. The mortgage application process should commence around 3 months before the property is due to be delivered

Latest Spanish mortgage news and updates

Santa Rosalia Development Murcia

Applications for Mortgages in Spain

Article helping buyers understand the Mortgage application process in Spain. How Spanish Banks view non resident mortgages. What documents are required when applying for a mortgage in Spain. How appointing a regulated and experienced mortgage broker can help achieve savings in time and money.

Spanish mortgage products 2026

Early January 2026 a numer of Spanish Banks have updated their Spanish Mortgage portfolio. The chnages include some reductions and increases to minimum rates. Along with introduction of new terms and conditions. Contracting of linked products is normally required to achieve lowest rate possible.

Spanish residency options and Mortgage facilities

Individuals with Spanish residency can be confused as to what Mortgage facilities in Spain will be availble to them. Having a resident card does not immediatly provdie access to resident mortgages in Spain. Whilst Spanish Banks provide non resident mortgages. Therefore lending will be possible. Banks in Spain have other criteria to offer the higher loan to values that Nationals can gain.

Understanding interest rates for a mortgage in Spain

Understanding Spanish interest rates is important when looking at a mortgage in Spain. Applicants should take professional advice as to what loan product types are available. How they work and what type of rate will be most suitable for their circumstance. Depending on a number of factors. Including requirement for stability versus overall rate. Fixed rate Spanish mortgages are available for the lifetime of the loan. As are variable trackers. Understanding the pros and cons of each product helps an applicant decdie what is best for them.

Finance for a Holiday Home in Spain for Americans

More and more US citizens are considering buying abroad. Spain is now one of the most visited countries in the world. With an active non resident mortgage market Americans can obtain a mortgage in Spain up to 70% loan to value. Other financing options are available for American buyers in Spain. However a Mortgage in Spain can minimise the currency risk on large transactions. Interest rates average 3.5%, and have been stable for many months.

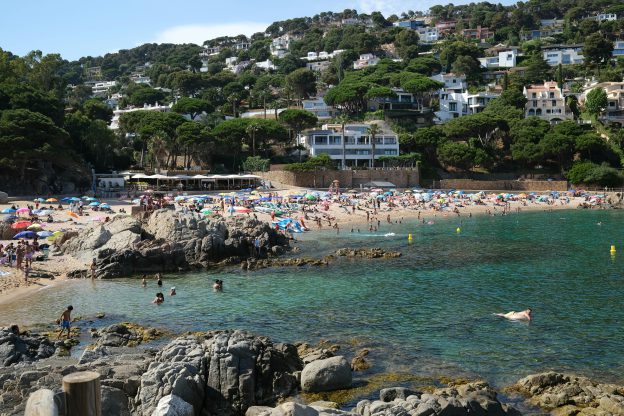

Financing a holiday home in the Costa Brava

The Costa Brava is a stunning region. Diverse and beautiful. It provides a myriad of options for those considering buying and financing a holiday home in Spain. Historical but providing both traditional and modern options. A non resident Spanish mortgage, with low interest rates can help buyers achieve their dream home.

New Mortgage product in Spain

A new mortgage product in Spain for non resident applicants has been launched. The loan allows for up to 75% loan to value. This level of loan to value for a mortgage in Spain has not been seen since the Banking crisis. For other Spanish Banks the maximum is 70%. In this article we explain the new product for non resident Spanish lending. What terms and conditions apply. Also the criteria for qualification. As independent Spanish Mortagge brokers we are always searching the market for the best solutions for our clients.

Euribor index for Spanish Mortgages

The Euribor index for Spanish Mortgages is what all Spanish lenders link their rates to. Whilst the 12 month Euribir has been dropping slowly and steadily. September saw a small increase to 2.114%. This increase has little affect on what Spanish Banks can offer non resident borrowers. Interest rates remain stable and fixed rates can be gained below 3%.

Spanish Mortgage Market 2025

Spanish Mortgage market in Spain for 2025. What has happened to interest rates during the year. Information on how Spanish Banks are currently viewing non resident applications. Using a fully regulated broker will normally help to obtain a mortgage in Spain with the best possible terms and conditions. Understand what criteria the Spanish Banks look for during the underwriting process. What defines a strong versus weak application.